Kennedy Edgerton is definitely an Updates Editor over the Mortgages and Loans workforce, leveraging his enthusiasm for crafting and personal finance to provide stimulating information that empowers readers to improve their life by means of advised selection-producing.

Our on line varieties are very easy to complete with the ease and comfort of your personal household and may be done in minutes.

The process differs by lender and monetary problem, but most competent borrowers can near over a mortgage loan loan inside about thirty days.

If the student dies or gets disabled, any withdrawals that take place following that celebration may even not result in The ten% tax penalty.

A number of aspects ascertain The present property finance loan premiums, like financial indicators for example inflation and unemployment along with steps because of the Federal Reserve. The costs transform every single day, Which explains why most lenders publish currently’s home finance loan prices on their homepages.

These inquiries don’t influence your loan request but assist us discover you extra fiscal remedies at no cost. Do you've $ten,000 or even more in bank card debt?

Home and board — the beneficiary have to be at least a fifty percent-time scholar; incorporates off-campus housing nearly the cost of on-campus room and board

Regular home loans demand a 3% deposit. They help you finance a home worthy of as much as an yearly greatest founded by Fannie Mae, a federally-primarily based property finance loan business.

And Though you could’t deduct 529 contributions on here your federal tax return, some states offer you condition revenue tax deductions and tax exemptions on withdrawals.

People that panic losing money on their expenditure very likely will pick a conservative plan which offers considerably less exposure towards the stock market.

Loans terms made available via Improve vary from 24 to eighty four months. Once you apply and obtain authorised for a suggestion, you are able to choose what loan phrase operates ideal in your case. And recall, you may generally fork out your loan off early without headache or early payoff costs!

A fifteen-yr mortgage has higher regular payments but cheaper fascination above the life of the loan. The solution is determined by your particular person circumstance and financial ambitions.

Tax penalties for selected withdrawals. Do your best to make sure you can find the money for your contributions as element of your respective family spending budget, this means you gained’t really have to withdraw the funds you put in.

If distributions are utilized for nonqualified charges, earnings are subject to federal taxes plus a ten% penalty. States might also impose taxes and penalties. Talk to your economic advisor that will help you should definitely’re not overfunding your strategy.

Michael C. Maronna Then & Now!

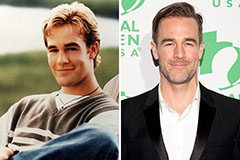

Michael C. Maronna Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!